The ProSiebenSat.1 Share

This section is part of the audited Combined Management Report.

- Since March, ProSiebenSat.1 became the first German media company to be listed in the leading DAX index.

- The Group generates issue proceeds of EUR 515 million (gross) from the placement of new shares. The capital increase enlarges the financial headroom for investments and further growth from acquisitions. We also want our shareholders to participate appropriately in this in the future.

- ProSiebenSat.1 is pursuing an earnings-oriented dividend policy. The Annual General Meeting proposes a dividend payout of EUR 1.80 per share for 2015.

Development of Stock Markets

The stock market in 2016 was influenced by several uncertainties relating to both the domestic and the international economy. The reasons for this included the effects of the high refugee migration and the disintegrative political movements in Europe. The referendum on Great Britain leaving the European Union (EU), known as Brexit, was a particularly striking event. On June 24, 2016, the day after the referendum on the exit, the global financial and foreign exchange markets recorded significant price declines. The presidential election campaign in the US also led to uncertainties within the capital market. In addition, there were terror attacks in Europe. The economic situation in Asia and resulting developments on commodity markets — particularly the low price of crude oil — also led to price declines. Positive signals were provided by economic growth in the US and the continued expansionary monetary policy of the European Central Bank (ECB). In early December, the ECB extended its bond purchasing program until the end of 2017, causing the DAX to rise to a high of 11,481.06 points by the end of the year.

Overall, in 2016 the interrelated influencing factors led to substantial price fluctuations impacting the stock markets. Despite the geopolitical uncertainties mentioned above, the DAX closed the trading year with an increase of 7 %. The relevant sector index for European media stocks, the EURO STOXX Media, closed at 220.18 points, representing a minus of 6 %.

ProSiebenSat.1 on the Capital Market

ProSiebenSat.1 Media SE was the first German media company to be listed in the DAX. The Company has been listed since March 2016. The share’s highest closing price of EUR 48.66 was reached on March 1. Over the past five years, the share’s value has nearly tripled. In the course of the year 2016, however, the volatile economic data mentioned above impacted the share price.

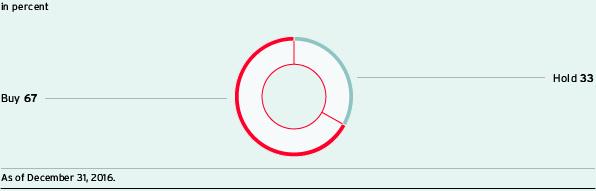

The majority of analysts (67 %) recommended the ProSiebenSat.1 share as a buy at the end of 2016, while 33 % were in favor of holding the share. As such, there were no sell recommendations for the share as of December 31 (Fig. 12). The analysts’ median price target was EUR 45 (previous year: EUR 51). At the end of the year under review, a total of 27 brokerage firms and financial institutions actively analyzed the ProSiebenSat.1 share and published research reports. Recommendations by financial analysts are an important basis for decision making, particularly for institutional investors.

Analysts' recommendations (Fig. 12)

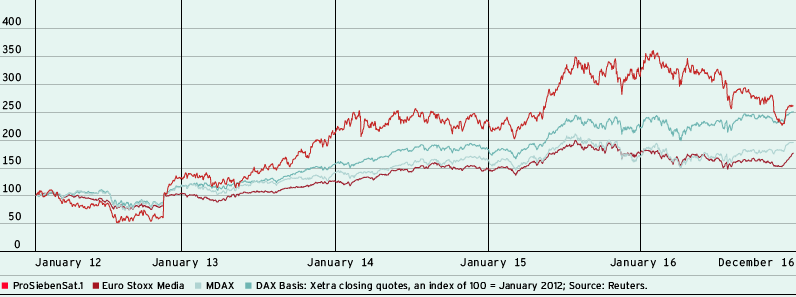

Media stocks in Europe performed somewhat more weakly as a whole in the 2016 trading year (Fig. 13). One of the reasons for this was temporary uncertainty regarding the development of the TV advertising market. This is also reflected by the performance of the ProSiebenSat.1 share. At its Capital Markets Day in October, ProSiebenSat.1 Group slightly lowered its growth forecast for TV advertising revenues in 2016. In addition, the geopolitical uncertainties characterized the development of the ProSiebenSat.1 share.

With effect from November 7, ProSiebenSat.1 increased the Company’s share capital by around 6.5 % from EUR 218,797,200.00 to EUR 233,000,000.00 by issuing 14,202,800 new, registered shares in exchange for cash contributions, making partial use of the Authorized Capital. The increased number of shares resulted in dilution, with the share price falling to EUR 31.80 on November 29. In the context of the general year-end rally on the markets, the share closed the 2016 trading year at EUR 36.61 — and was thus slightly higher than its level before the capital increase if the dilution was taken into account. The TV advertising market also contributed to this, displaying positive momentum at the end of the year.

In the financial year 2015, the ProSiebenSat.1 share increased by a particularly strong 34 % to EUR 46.77 and considerably outperformed the comparative indices. The 2016 trading year was weaker in comparison, with the share declining by 22 % compared to December 31, 2015.

Price performance of the ProSiebenSat.1 share (Fig. 13)

ProSiebenSat.1 share: Basic data (Fig. 14) |

||

|

|

|

Name |

ProSiebenSat.1 Media SE |

|

Type of share |

Registered common share |

|

Stock exchange listing |

Frankfurt Stock Exchange: Prime Standard/regulated market |

|

Sector |

Media |

|

ISIN |

DE000PSM7770 |

|

WKN |

PSM777 |

|

Based on the closing price for 2015 and a dividend payment of EUR 1.80 per dividend-entitled share, the dividend yield amounted to 3.8 % (previous year: 4.6 %).

ProSiebenSat.1 share: Key data1 (Fig. 15) |

||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

|

2016 |

2015 |

2014 |

2013 |

2012 |

||||||||||||||

|

||||||||||||||||||||

Share capital at reporting date |

EUR |

233,000,000 |

218,797,200 |

218,797,200 |

218,797,200 |

218,797,200 |

||||||||||||||

Number of common shares as of closing date |

Units |

233,000,0002 |

218,797,2002 |

218,797,2002 |

218,797,2002 |

109,398,600 |

||||||||||||||

Number of preference shares as of closing date2 |

Units |

–/– |

–/– |

–/– |

–/– |

109,398,6002 |

||||||||||||||

Free float market capitalization at end of financial year (according to Deutsche Börse) |

EUR m |

8,149 |

10,214 |

7,271 |

6,024 |

4,660 |

||||||||||||||

Close at end of financial year (XETRA) |

EUR |

36.61 |

46.77 |

34.83 |

36.00 |

21.30 |

||||||||||||||

High (XETRA) |

EUR |

48.66 |

50.70 |

35.55 |

36.00 |

23.83 |

||||||||||||||

Low (XETRA) |

EUR |

31.80 |

33.31 |

28.35 |

21.85 |

14.19 |

||||||||||||||

Dividend per entitled common share |

EUR |

–/–3 |

1.80 |

1.60 |

1.47 |

5.63 |

||||||||||||||

Dividend per entitled preference share |

EUR |

–/– |

–/– |

–/– |

–/– |

5.65 |

||||||||||||||

Total dividend |

EUR m |

–/–3 |

386 |

341.9 |

313.4 |

1,201.4 |

||||||||||||||

Underlying earnings per share4 |

EUR |

2.37 |

2.18 |

1.96 |

1.78 |

1.67 |

||||||||||||||

Dividend yield per preference share on basis of closing price |

Percent |

–/–3 |

3.8 |

4.6 |

4.1 |

26.5 |

||||||||||||||

Total XETRA trading volume |

Million units |

231.2 |

158.9 |

179.9 |

170.0 |

134.1 |

||||||||||||||

As of December 31, 2016, the weighting in the DAX amounted to 0.89 %; this is calculated on the basis of market capitalization by free float and trading volume in the last twelve months (Fig. 16). The index lists the 30 largest listed companies in Germany in terms of market capitalization and trading volume. The EURO STOXX Media sector index pools stocks from media and media-related companies. ProSiebenSat.1 Media SE is represented here with a weighting of 8.68 %.

Selected index data (Fig. 16) |

||||

|

|

|||

Index |

Weighting |

|||

|

||||

DAX |

0.89 % |

|||

CDAX |

0.70 % |

|||

HDAX |

0.71 % |

|||

Prime All Share |

0.67 % |

|||

EURO STOXX Media |

8.68 % |

|||

Annual General Meeting for Financial Year 2015

The Annual General Meeting of ProSiebenSat.1 Media SE for the financial year 2015 took place on June 30, 2016. Around 750 shareholders, shareholder representatives and guests took part in the meeting. This was ProSiebenSat.1’s first Annual General Meeting as a DAX member. Attendance was around 67 % of share capital (previous year: approx. 42 %).

Shareholders approved the dividend proposal for financial year 2015 and resolved to distribute a dividend of EUR 1.80 per share. This equates to a total payout of EUR 386 million and a payout ratio of 82.6 % of Group underlying net income. The dividend was paid out on July 1, 2016. Moreover, Ketan Mehta was elected to the Supervisory Board. In November 2015, Mehta already succeeded Philipp Freise by way of judicial appointment. The Annual General Meeting also approved all other proposed resolutions with a large majority.

Shareholder Structure of ProSiebenSat.1 Media SE

In 2016, the Group also covered its refinancing requirements on the bank and bond market. Further information on the financing structure can be found in the “Borrowings and Financing Structure” section.

Group Financial Position and Performance

Since June 2016, the Group has offered a share program for employees known as MyShares. Further information is available in the Employees section.

With effect from November 7, 2016, ProSiebenSat.1 Media SE increased the Company’s share capital by around 6.5 % in exchange for cash contributions, making partial use of the Authorized Capital. The share capital was increased by a nominal amount of EUR 14,202,800.00 from EUR 218,797,200.00 to EUR 233,000,000.00 by issuing a total of 14,202,800 new, registered shares. The new shares are entitled to receive dividends from January 1, 2016. They were offered to institutional investors in a private placement by way of an accelerated bookbuilding process. Like the Company’s existing shares, the new shares are admitted to trading on the regulated market of the Frankfurt Stock Exchange as well as in the Prime Standard segment and the regulated market of the Luxembourg Stock Exchange.

ProSiebenSat.1 shares are mostly held by institutional investors in the USA, the UK and Germany. In total, 98.2 % were held in free float as of December 31, 2016 (December 31, 2015: 97.9 %) (Fig. 17).

Shareholder structure of ProSiebenSat.1 Media SE as of December 31, 2016 (Fig. 17) |

||||||||||||

|

||||||||||||

|

||||||||||||

|

|

|

|

|

||||||||

Free float |

|

ProSiebenSat.11 |

||||||||||

|

|

|

|

|

||||||||

98.2 % common shares |

|

1.8 % common shares |

||||||||||

|

|

|

|

|

||||||||

ProSiebenSat.1 Media SE2 |

||||||||||||

|

||||||||||||

Capital Market Communication

We provide regular information on all key events and developments at ProSiebenSat.1 to ensure the transparent communication of our financial figures and growth prospects. On the website www.ProSiebenSat1.com, all relevant company information is published in German and English promptly and on an ad-hoc basis where necessary. Further tools for providing extensive information to the capital market are press conferences and events for investors and analysts. In addition to 19 road shows, ProSiebenSat.1 also presented itself at 23 investor conferences in Europe and the US in 2016. Another important event is the Capital Markets Day held in October each year, at which the Group explains its growth strategy. The Investor Relations activities are complemented by the ProSiebenSat.1 investor hotline.

Numerous awards attest to the high-quality content of the ProSiebenSat.1 Annual Report and the Company’s transparent financial communication (Fig. 18).

Awards for ProSiebenSat.1’s capital market communication (Fig. 18) |

||

|

|

|

Institutional Investor (trade magazine) |

“Most Honored Company” (overall winner) |

|

German Investor Relations Award |

“IR Professional DAX” (6th place, Dirk Voigtländer — Head of Investor Relations) |

|

Best Annual Report |

“Overall Evaluation in the DAX” (3rd place) |

|

Investors’ Darling |

“Overall Evaluation in the MDAX” (1st place, annual and half-year report, investor presentations, and Investor Relations website) |

|

Corporate Communication Institute (CCI) |

“DAX Annual Report, Print” (classified as “excellent”) |

|