Technical Distribution, Media Consumption and Advertising Impact

The range of transmission routes is becoming more diverse in the wake of the digital transformation, whereby television is gaining in attractiveness thanks to new ways to use it: Examples include digital television in high definition (HD), catch-up television via apps on mobile devices, and video-on-demand (VoD) on large TV screens. The use of these new services goes hand in hand with the expansion of broadband Internet connections and the growing number of satellite households in Germany (Fig. 35):

- The number of broadband Internet connections in Germany has tripled over the last ten years. In 2016, 31.2 million connections were active. This corresponds to an increase by 0.5 million broadband Internet connections.

- Satellite connections are now available across the country, making them the most significant distribution channel for TV stations. In April 2012, the analog satellite signal was switched to digital signals. In 2016, nearly 18 million households in Germany received TV programs via satellite (previous year: approx. 17 million).

TV households in Germany by delivery technology (Fig. 35) |

||||||||||||||||

|

|

|

|

|

|

|||||||||||

TV households |

Potential in millions |

Terrestrial |

Cable |

Satellite |

IPTV |

|||||||||||

|

||||||||||||||||

20151 |

37.03 |

1.30 |

16.09 |

17.07 |

2.56 |

|||||||||||

20162 |

38.19 |

1.30 |

15.81 |

17.89 |

3.19 |

|||||||||||

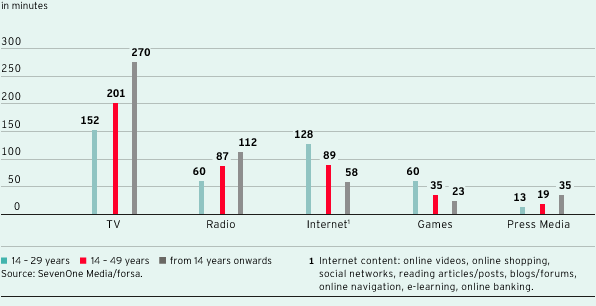

The results of the “Media Activity Guide 2016” study conducted by forsa at the beginning of 2016 on behalf of the ProSiebenSat.1 advertising sales company SevenOne Media give a detailed insight into media usage behavior in Germany. People in Germany use media and media transmission channels for an average of 572 minutes every day. Television remains the most popular and highly used medium. Viewers aged over 14 years spend nearly half of their daily media use on TV. Radio follows in second place, with 112 minutes of daily use. Content-driven Internet usage accounts for 58 minutes of this time frame. Reading newspapers and magazines accounts for 35 minutes every day (Fig. 36).

Average daily media use (Fig. 36)

In Germany, data on television use is collected on a daily basis on behalf of Arbeitsgemeinschaft Fernsehforschung (AGF) as part of a TV panel measurement. According to this, daily viewing time in the group of viewers aged 14 and above saw another slight increase to 239 minutes in 2016 (previous year: 237 minutes). This highlights the significance of TV as the number one medium in Germany. The following trends can be discerned:

- In 2016, linear TV consumption — which takes place live at the time of broadcasting the TV program — in the German market amounted to nearly three hours per day among viewers aged between 14 and 49. This means that TV is still the most used medium. 85 % of those surveyed use TV primarily as a means to relax. For viewers aged 14 and above, it was 81 %. New services like HD television are further increasing the attractiveness of TV. Most German households have an HD-ready TV set (78 %).

- Television is the most significant provider of video content: In Germany, 98 % of video usage among viewers over the age of 14 is still attributable to TV. In particular, private broadcasters are being watched: In 2016, they achieved a market share of 50.8 % in the target group of individuals aged 14 and above. Among the relevant target group of 14- to 49-year-olds, the private stations reached 71.5 %. At the same time, the Internet is firmly established in everyday life of media recipients. In 2016, the share of Internet users in Germany was 85 %. This means that TV content can be watched anywhere at any time using different devices. As mobile devices are becoming more widespread, even people without a TV set can watch linear TV programs.

- Young media recipients aged between 14 and 29 spend three quarters and thus most of their video usage time on TV. By contrast, the daily amount of time spent on Youtube is stagnating both in the advertising-relevant group of people aged 14 to 49 and in the young target group of users aged 14 to 29. Overall, only 9 % of Youtube users account for 67 % of the total usage volume on Youtube. The spread of Facebook is even decreasing: In the target group of 14- to 19-year-olds, its daily reach is declining (2016: 40 % vs. 2015: 49 % almost daily usage) while the share of non-users is increasing (2016: 36 % vs. 2015: 29 % no usage).

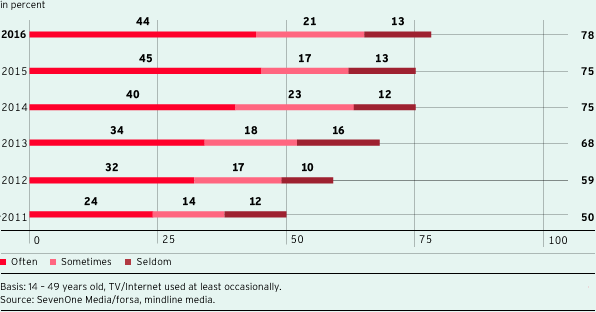

- The simultaneous use of television and the Internet characterizes the everyday use of media. While the share of parallel users aged between 14 and 49 was 51 % five years ago, this figure amounted to 78 % in 2016 (Fig. 37). The share of frequent parallel users even rose by 20 percentage points to 44 % within the same period. This has an incentive effect on both media usage behavior and the advertising impact of TV. Second-screen users are not just tech-savvy individuals. They also have a stronger interest in TV content. Every day, they watch 228 minutes of TV, which corresponds to an additional 27 minutes compared to the average in their age group (14- to 49-years-old). At the same time, nearly half of all Germans (43 %) have purchased something on the Internet as a result of TV content. More than half (59 %) feel an impulse to research products as a result of TV.

Parallel usage TV/Internet (Fig. 37)

Television is the largest mass medium in Germany. In 2016, 71 % of viewers aged 14 and above watched television on an average day. This figure has not changed since last year. This means that the monthly net reach is stable at a high level. At the same time, the relevance of advertising via TV spots is increasing compared to other media: TV advertising has the highest impact and no other medium is capable of building up such a high reach in all target groups so quickly. Nothing has changed here, even in the course of digitalization. The monthly net reach of leading Internet portals, such as Youtube in Germany is only about half as high as that of German private stations.

In addition, TV advertising has a strong impact: Emotions towards a brand is higher with video advertising on TV compared to any other media. This results in brand loyalty among consumers and pays off for advertisers in the short and long term. This was shown in the „ROI Analyzer“ study jointly published by SevenOne Media, GfK-Fernsehforschung and GfK-Verein in 2014. The study evaluated the revenue effects of TV advertising on all purchase data from 30,000 German households over a year. The results showed that, across all brands investigated, a TV campaign will pay for itself after only one year, with an average return on investment (ROI) of 1.15. This figure increases to 2.65 after five years.

Refinancing models have also developed as a result of digitalization. Additional pay-per-view offers, such as pay TV or VoD, are offering ProSiebenSat.1 Group additional growth prospects. Germany is still a traditional free TV market. Nevertheless, pay VoD is growing dynamically. In 2016, the volume of the pay VoD market was EUR 484 million. In addition, the ad VoD market offers enormous growth potential and is expected to grow by around 50 % in Germany by 2018.

At the same time, new markets are emerging for marketing on TV and benefiting from the opportunities provided by the Internet as a distribution channel. In 2016, e-commerce on all digital devices in Germany grew by around 11 % to a market volume of EUR 52.3 billion. In total, e-commerce probably accounted for 10.8 % of retail overall. This was the result of a current study by the Institute of Retail Research in Cologne (Institut für Handelsforschung Köln). According to this study, mobile commerce is likely to have been of great significance for e-commerce growth in Germany in the period under review, generating EUR 18.7 billion in revenues for retailers (previous year: EUR 13.5 billion). Thereof, EUR 12.8 billion is likely to have been attributable to smartphones and EUR 5.9 billion is likely to have been attributable to tablets. This corresponds to approximately 36 % of online revenues in Germany overall. The single e-commerce areas differ in their dynamic. Despite geopolitical uncertainty, in 2016 the online travel market in Germany developed at the level of the previous year in key travel destinations. According to own calculations, the German market volume was EUR 25.26 billion.