Risk Report

- We have an effective risk management system.

- The overall risk situation remains limited.

Risk Management System

ProSiebenSat.1 Group has established a standardized risk management system. It focuses on the Group’s specific circumstances and covers all activities, products, processes, departments, investments and subsidiaries that could have an impact on our Company’s business performance. Newly acquired units are being systematically integrated in the risk management system.

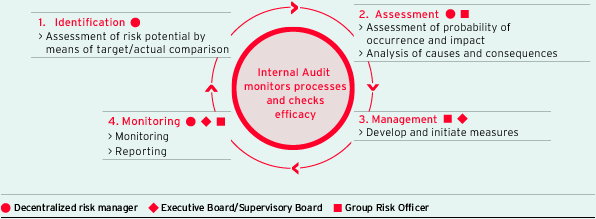

Risk is defined in this report as a potential future development or event that could significantly influence our business situation and result in a negative deviation from targets or forecasts. The risk indicators that we have already taken into account in our financial planning or in the Consolidated Financial Statements as of December 31, 2016, do not therefore come under this definition and are consequently not explained in this Risk Report. Risk management comprises four interlinked process steps:

- Identification: The basis is to identify material risks by means of a target/actual comparison. The decentralized risk managers are responsible for this. For this purpose, they use early warning indicators defined for relevant circumstances and key figures. For instance, a key early warning indicator for the TV business is the development of audience shares.

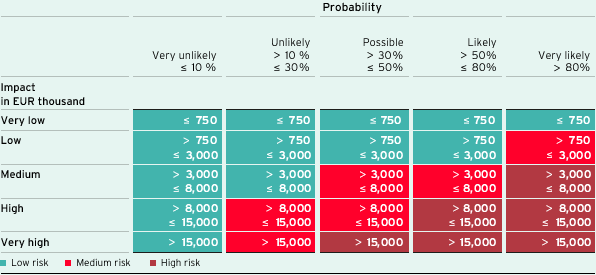

- Assessment: The relevant risks are assessed on the basis of a matrix (Fig. 90). Firstly, the circumstances are categorized on a five-level percentage scale in terms of the probability of their occurrence. Secondly, their level of potential financial impact is estimated; the financial equivalents are likewise broken down into five levels.

Using the matrix presentation, potential risks are classified as “high,” “medium,” or “low” depending on their relative significance. As well as classification, risk assessment also includes analyzing causes and interactions. Measures to counteract or minimize risks are included in the quantification (net assessment). In order to obtain the most precise view of the risk situation possible, however, opportunities are not taken into account. These are recorded by ProSiebenSat.1 in its budget planning.Risk classification (Fig. 90)

- Management: Using appropriate measures, ProSiebenSat.1 can reduce the probability of occurrence of potential losses and limit or reduce possible damage. In order to handle risks safely, it is therefore very important to develop and initiate countermeasures as soon as an indicator reaches a certain tolerance limit.

- Monitoring: Risk monitoring and risk reporting round off the risk management process. The aim is to monitor changes and review the effectiveness of the management measures taken. Monitoring also includes documentation, which ensures that all hierarchy levels relevant to decision-making have adequate information on risks.

Risk management process (Fig. 91)

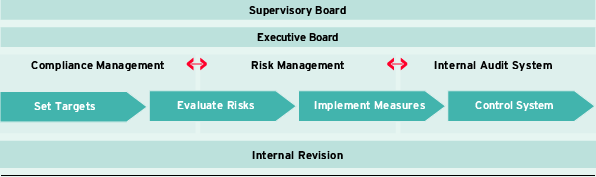

The fundamental requirements for handling risks safely throughout the Group include clear decision-making structures, standardized guidelines, and a methodical approach by the responsible bodies. At the same time, processes and organizational structures must be flexible enough to allow ProSiebenSat.1 to respond appropriately to new situations at all times. For this reason, the regular classification of risks takes place on a decentralized basis and thus directly in the different corporate units (Fig. 90 – 92).

- Decentralized risk managers: The risk managers identify the risks from their respective area of responsibility according to the standard Group system described. They document their results in an IT database every quarter.

- Group Risk Officer: The Group Risk Officer reports the risks identified in the database to the Executive Board and Supervisory Board on a quarterly basis. In addition, relevant risks arising at short notice are reported immediately. In this way, the Executive Board and Supervisory Board receive all analyses and data relevant for decision making regularly and at an early stage so that they can respond proactively.

- The Risk Office supports the various corporate units in identifying risk at an early stage. It also ensures the efficacy and timeliness of the system by training the decentralized risk managers and continuously monitoring the scope of risk consolidation. Moreover, the Internal Audit unit regularly reviews the quality and compliance of the risk management system. It reports the results directly to the Group CFO.

Risk management system (Fig. 92)

In 2016, the audit of the risk management system generated a positive result again. The system itself did not change in the past financial year. The basis for the audit is the Risk Management Manual. It summarizes company-specific principles and is based on the internationally recognized frameworks for enterprise risk management and internal control systems from COSO (Committee of Sponsoring Organizations of the Treadway Commission).

Development of Risk Clusters

Risk Categories and Overall Risk Situation

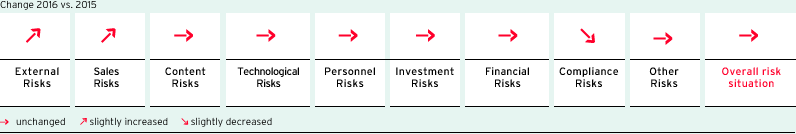

Our overall risk situation remains limited. It is largely unchanged year-on-year, although some of the individual risk clusters have increased or decreased slightly compared to December 31, 2015 (Fig. 93).

The assessment of the overall risk situation is the result of an aggregate analysis of the Group’s main risk clusters: “operating risks,” “financial risks,” “compliance risks,” and “other risks”; due to their thematic diversity, ProSiebenSat.1 also subdivides operating risks into external risks, sales risks, content risks, technological risks, personnel risks, and investment risks.

The risk clusters in turn comprise various different individual risks. To assess the overall risk situation, ProSiebenSat.1 therefore initially classifies all individual risks as part of the quarterly assessment process and aggregates them in the nine specified clusters based on the matrix described above (Fig. 90). When assessing the overall risk situation, ProSiebenSat.1 weights the clusters according to their significance for the Group.

Development of risk clusters and the overall risk situation of the Group as of December 31, 2016 (Fig. 93)

In the following pages, we describe the various different individual risks and explain their categorization. These are not necessarily the only risks that the Group faces. However, we are not currently aware of any additional risks that could impact our business activities, or we consider them as not material.

Operating Risks

Operating Risks (Fig. 94) |

||||||||||

|

|

|

|

|

||||||

|

Impact |

Probability of |

Significance of |

Change compared |

||||||

|

||||||||||

EXTERNAL RISKS |

|

|

|

|

||||||

Macroeconomic risks |

high |

possible |

medium |

slightly increased |

||||||

General industry risks (media usage behavior) |

very high |

unlikely |

medium |

unchanged |

||||||

SALES RISKS |

|

|

|

|

||||||

Media convergence |

high |

possible |

medium |

unchanged |

||||||

Selling advertising time |

very high |

unlikely |

medium |

unchanged |

||||||

Online avertising (ad blockers) |

high |

possible |

medium |

unchanged |

||||||

Audience shares |

high |

possible |

medium |

slightly increased |

||||||

CONTENT RISKS |

|

|

|

|

||||||

Licence purchases |

moderate |

very unlikely |

low |

unchanged |

||||||

Commissioned and in-house productions |

moderate |

unlikely |

low |

unchanged |

||||||

TECHNOLOGICAL RISKS |

|

|

|

|

||||||

Broadcasting equipment |

low |

unlikely |

low |

unchanged |

||||||

Studio, post-production, and IT systems |

low |

unlikely |

low |

unchanged |

||||||

PERSONNEL RISKS |

|

|

|

|

||||||

|

moderate |

unlikely |

low |

unchanged |

||||||

INVESTMENT RISKS |

|

|

|

|

||||||

Risks from majority interests |

moderate |

unlikely |

low |

unchanged |

||||||

Risks from minority interests |

moderate |

unlikely |

low |

unchanged |

||||||

External Risks

The development of the German TV advertising market is our most important planning assumption. In addition to general economic growth, we include sector-specific data such as the reach of TV in our economic considerations.

Macroeconomic risks. By their nature, economic forecasts entail some uncertainties; this particularly applies to their potential financial implications for the advertising market. ProSiebenSat.1 analyzes economic and market developments continuously and assesses them systematically as part of risk management.

Although the research institutes expect growth in Germany to level off slightly in 2017, partly due to political uncertainties, the general upward trend looks set to continue. We therefore believe that the risks from general economic conditions have increased slightly, but we still classify high negative effects as possible. We therefore still rate this category as a medium risk. The domestic economy in Germany is developing positively overall, meaning that TV advertising investment in our main sales market is also likely to increase further.

Industry experts’ growth forecasts for the German net TV advertising market are optimistic. Our own forecasts for 2017 are based on low single-digit percentage growth of the German advertising market. At the same time, investments in online advertising are likely to increase, with in-stream videos continuing to develop dynamically. In addition to a generally positive industry environment, our assumptions are also based on a structural change in the German advertising market: While print advertisements are becoming less relevant as a result of digitalization, online advertising is gaining market share and TV is maintaining its high level.

ProSiebenSat.1 is pursuing a digital growth strategy, thus diversifying its revenue and risk profile in all segments. In the economically sensitive core business of television, one key element of this strategy is to reach new target groups. Since 2010, the Group has launched four new special-interest stations in Germany, thereby freeing up additional advertising budgets and expanding its advertising inventory. In addition, ProSiebenSat.1 systematically invests in new growth markets such as HD distribution and thus in business areas that are funded independently of advertising revenues in the Broadcasting German-speaking segment, too. The Group already generated 47 % of its revenues outside the TV advertising business in 2016, whereas in 2015 the figure had been 40 %.

General industry risks (media usage behavior). Technological change, and particularly the growing use of the Internet, is influencing media usage behavior. Media usage today mainly reflects more individual requirements: TV content is consumed using different devices and can thus be watched anywhere and at any time. Nonetheless, the majority of Germans prefer to watch television in a “lean-back mode.” According to the Media Activity Guide, 81 % of those surveyed want to lean back and relax when watching television. 94 % of German households have at least one TV set, meaning that the number of sets has remained stable.

However, the television sets themselves are developing further as a result of technical innovations, such as the possibility to watch television in high-definition (HD) quality and larger screens, and their quality is improving. In everyday life, usage patterns such as parallel consumption of TV and Internet are also on the rise: 55 % of 14- to 49-year-olds frequently use the Internet on their smartphones while watching television. Mobile devices therefore form part of the everyday use of media, but are not replacing the TV set. Instead, they serve as “second screens” and perform additional functions such as online searches and communication via social media channels. In this context, research methods also showed that a multimedia presence increases viewer retention, particularly among young people. This results in benefits for marketing, too: Firstly, online campaigns reach new target groups, and secondly, online contacts reinforce the effectiveness of TV advertising.

New forms of use such as time shifting on TV currently account for a small share: 98 % of TV consumption by viewers aged over 14 in Germany still relates to live use at the time of the broadcast. At the same time, the monthly net reach of television is recording a stable development at a high level. This applies to all viewer groups, particularly including the younger target group of 14- to 29-year-olds. On average in 2016, 46 % of viewers aged between 14 and 29 switched on their TV set every day. This figure did not change year-on-year in spite of the constantly growing number of other possible forms of media usage. An average daily viewing time of 119 minutes and thus almost two hours was calculated (previous year: 118 minutes).

Television will continue to dominate media use in the future: We expect consumption of TV content to increase by 3 % in total by 2020. Although consumption of television on stationary TV sets will decrease slightly to a viewing time of 162 minutes for the target group of 14- to 49-year-olds, it will, however, still be in first place. Meanwhile, the use of web-based free TV offers will increase. This means that more and more viewers will watch linear TV programming on PCs, laptops, or mobile devices. This form of use is becoming increasingly popular among younger viewers in particular and is expected to reach 32 minutes per day by 2020 already (currently 16 minutes per day, viewers aged 14 – 29).

These market data and research findings show that the digital transformation is taking place more slowly in Germany than in other countries. It is also following its own pattern. One structural feature of the German market is the broad range of offers on advertising-financed free TV. In contrast to the US and Scandinavian countries, in Germany the majority of stations are available for free and the quality of their programming is high. This is reflected in the number of pay TV and VoD subscriptions. While only 20 % of viewers in Germany currently subscribe to pay TV programs, around 83 % of US households do so. VoD offers are used by 11 % of households in Germany, compared to around 50 % in the US. In Scandinavian countries, the level of willingness to pay for additional offers is even higher, with the market penetration of pay TV amounting to between 91 % and 97 %. In this context, ProSiebenSat.1 is very well positioned to use the digital trend as a growth opportunity.

The Company is the market leader in the German audience market in the advertising-relevant target group of 14- to 49-year-old viewers, and in addition to free TV offers in SD quality it also offers its stations in HD. Parallel to this, ProSiebenSat.1 developed a digital entertainment range at an early stage and caters to new media usage habits with the online video portal maxdome and the TV apps. By inference, we still consider risks from a change in media use to be unlikely to materialize. In the event of a fundamental change, however, we cannot completely rule out a very high financial impact on our core business and thus the entire Group. We therefore rate this as a medium risk overall.

Sales Risks

Media convergence. No other technology has spread as rapidly over a period of just three years as smartphones and tablets. The prevalence of these devices among consumers aged 14 and over has increased by around 20 percentage points to 71 % and 38 % respectively in 2016. As a result, the once strong ties between content and end devices are coming somewhat undone and the lines between different media are blurring: The same content is now used on various channels on different devices. For example, Internet users are now listening to the radio and reading newspapers online. This development is being driven by broadband internet connections with fast data transfer rates. In light of the convergence of media, the future relevance of conventional television is repeatedly being questioned.

The research findings in the Media Activity Guide, an extensive study conducted by forsa on behalf of the ProSiebenSat.1 advertising sales company SevenOne Media, show that new forms of video usage are supplementing television. Entertainment devices such as smartphones and tablets are used in addition to TV sets instead of replacing them. At the same time, this parallel use does not have a negative impact on the use of linear television. For example, an analysis from the Media Activity Guide shows that 14- to 49-year-olds who frequently use the Internet and TV at the same time spend much longer both watching TV programs and also using online offers than the average for this target group. They spend 246 minutes watching TV, 22 % more than average, and the time they spend online is 28 % higher than average at 114 minutes. The additional available screens are also used to watch TV programming without TV sets: Among viewers aged between 14 and 49, roughly 6 % of TV usage is received via new methods such as live streams or TV sticks connected to PCs and laptops, compared to a figure of 4 % in 2015. Nonetheless, the high market penetration of convergent devices entails risks for ProSiebenSat.1. TV and online could not only be used in parallel with the consumption of video content on new devices rising overall, but convergence could also lead to a future reduction in TV use. This could in turn have a negative impact on advertising customers’ willingness to invest and thus negatively affect prices for TV advertising. Although we are not currently seeing substitution, we believe it is possible that this risk may materialize. We therefore cannot rule out high effects on our revenue or earnings performance and we continue to classify potential losses from media convergence as a medium risk. For this reason, we will continue to invest in both TV and digital entertainment and use our potential by networking our TV stations with digital offers to an even greater extent.

Selling advertising time. ProSiebenSat.1 Group moderately increased its prices for TV advertising space again in 2016 and freed up additional advertising budgets. Innovative marketing models such as addressable TV are an important growth measure in this context. Our customer base also comprises companies from a wide range of industries. The diversified portfolio of complementary free TV stations also helps to compensate for potential declines in advertising budgets in individual sectors.

In the vast majority of cases, ProSiebenSat.1 does not conclude advertising contracts directly with the advertising companies. Instead, media agencies function as intermediaries, which become direct contract partners for our sales company SevenOne Media GmbH. The market for TV advertising time is characterized by concentrated structures both on the demand and supply side. On the demand side, there are essentially seven large associations of media agencies, which usually consist in turn of many smaller agencies. These are faced on the supply side primarily by the two private broadcasting groups, ProSiebenSat.1 and RTL, and the public television stations. Because of this and the high attractiveness of television and its significance as the number one medium in the media mix, the business relationship formally concentrated on a few agencies does not give rise to any notable financial risk. Similarly, ProSiebenSat.1 has not identified any material default or liquidity risks because of the association structure described above and the short billing cycles of at most one month.

Should advertising budgets decline, the price level in the selling of advertising time fall or customers default, this could have very high consequences for the Group’s revenue and earnings performance. We are observing increasingly intense competition in the German advertising market, but continue to classify risks in connection with marketing our TV advertising time as a medium risk. We believe that they are unlikely to materialize. Nevertheless, we regularly identify and analyze the competitive environment and our advertising revenues and advertising market shares in order to detect potential losses at an early stage. By comparing projections and actual figures with the corresponding prior-year values, budget deviations can be spotted and countermeasures such as cost adjustments or changes in program planning and price policy can be quickly implemented as well.

Online advertising: Ad blockers. In connection with the sale of online advertising, ad blockers represent a sales risk. These programs, which are offered as browser plug-ins and now also as apps for mobile devices, prevent advertising from being displayed. ProSiebenSat.1 Group has taken various measures to limit this risk: The Company has introduced technical means that can effectively prevent the ad blockers from functioning. At the same time, we are raising our users’ awareness with education campaigns such as Stromberg-AdUcate. In addition, ProSiebenSat.1 has filed an application for an injunction against the most widespread ad blocker in Germany (AdBlock Plus). The proceedings are currently being held at the Munich Higher Regional Court.

However, further spreading of ad blockers is still possible and this could have a high impact on the success of online advertising business. Overall, we rate the total risk for ProSiebenSat.1 Group as a medium risk.

Audience shares. The risk of declines in the audience shares of our free TV stations has slightly increased year-on-year as new stations on the German free TV market are intensifying competition. Under these circumstances, we assess the implications of a decline in audience shares as high and the probability of occurrence as possible for this reason. Nonetheless, our risk classification has not changed overall and we continue to assess this category as a medium risk.

ProSiebenSat.1 Group is the leader in the German TV market and has a diversified station portfolio. In September 2016, the Group launched kabel eins Doku, a station aimed specifically at a male audience aged 40 to 64. After sixx, ProSieben MAXX and SAT.1 Gold, kabel eins Doku is the fourth special-interest station that ProSiebenSat.1 is offering in the German market. This multi-station strategy offers advantages in terms of marketing: The aim is to acquire new viewers and thus create additional advertising space by means of target-group-specific programming. With this strategy, the Group acquired more than 100 new customers in a highly competitive market for new customers in 2016. Overall, we have therefore identified no new effects on the ProSiebenSat.1 stations’ sale of advertising from the modified risk assessment.

Audience shares are an important performance indicator for managing the Group and also a key indicator for early risk detection: Firstly, they reflect how the programming offer meets the taste of the audience. In this way, they measure a program’s attractiveness and indicate its profitability. Secondly, they document the reach of an advertising spot and thus serve as proof of performance for our advertising customers. The Company therefore performs a daily analysis of the results on the basis of data from the Working Group of Television Research (AGF). In this way, ProSiebenSat.1 is able to measure the success of its formats and, if necessary, to take countermeasures at any time. In addition to quantitative analyses, qualitative studies are also an important control instrument. Program research at ProSiebenSat.1 cooperates closely with various institutes on this. ProSiebenSat.1 commissions them to carry out regular telephone and online interviews and group discussions with viewers in Germany. In this way, stations obtain direct feedback from their audience and thus can optimize and further develop their programs on an ongoing basis.

Content Risks

We continue to categorize content-specific risks as low; they have not changed in comparison to the previous year. In this context, the Group differentiates between risks from license purchases and risks in the context of commissioned and in-house productions.

License purchases. Exclusivity and novelty are characteristics of the quality of interesting program formats. Therefore, ProSiebenSat.1 Group uses exclusive agreements in the form of contractual blocking periods (hold-back clauses) to protect its rights against other licensees and program licensing forms. In order to stay informed about trends and new productions at an early stage, our purchasing department is also in constant dialog with national and international licensors. Nonetheless, we cannot completely rule out future risks from license purchases, but we consider them very unlikely. In this event, a moderate impact on the Group’s earnings performance would be conceivable. Overall, we classify this as a low risk. We base our assessment on the following issues:

ProSiebenSat.1 Group is exposed to currency risks when purchasing program licenses, because it acquires many of its feature films and series from the major US studios. The Group limits this risk with derivative financial instruments. Furthermore, price increases could also influence license purchases and therefore our business performance. In the buying market, the Company is in competition with other players, including well-funded international competitors with their own VoD platforms and headquarters in the US. However, ProSiebenSat.1 Group has a diversified supplier base and contracts with all major US studios. In addition to close business relationships with licensors, a high purchasing volume secures the Group’s strong negotiating position that enables it to purchase exclusive programming at attractive conditions. In addition, programming contracts are often signed some years before production and broadcast. This guarantees our supply of programming in the long term.

Nonetheless, the competition for attractive content could intensify further as a result of growing competition from international market participants and new digital offers. In addition, individual purchases are becoming a more frequent necessity, especially for small TV stations, as their programming is very specifically targeted. Moreover, signing programming contracts early does not have only advantages. It also harbors a certain potential risk with regard to future program formats if their quality and success is not as expected. In this event, it might be necessary to invest in additional programming. To proactively minimize this risk, ProSiebenSat.1 therefore only makes long-term programming agreements with film studios and production companies with an appropriate reputation and successful track record. In any case, we have also identified a low potential loss in connection with the currently high proportion of US programs on our free TV stations. US formats such as “NAVY CIS” and “The Big Bang Theory” are hugely popular and achieve large audience shares in Germany.

Commissioned and in-house productions (local productions). Commissioned and in-house productions are designed specifically for individual stations and thus strengthen the recognition value of a station. Because reference figures such as ratings are sometimes unavailable, the prospects for the success of local formats tend to be riskier than for licensed formats that have already been successful in other countries or in the movie theaters. ProSiebenSat.1 Group therefore focuses on an individual and generally balanced mix of licensed programs as well as commissioned and in-house productions.

In order to assess the appeal of its in-house productions as reliably as possible, ProSiebenSat.1 conducts intensive market analyses. Researchers accompany the development of new program formats using a wide range of different methods, in many cases as early as the concept or screenplay stage. So-called real-time response tests (RTR) are a frequently used instrument. They are deployed when initial sequences or a pilot episode are available for new TV programs. When programs are screened, test persons document their response and reactions using a type of remote control, with accuracy down to the second and in real time. Another measure to limit risk is the internal format management process, whereby the program goes through several approval stages from development to implementation in order to ensure quality and success.

Although we believe it is unlikely that risks connected to local productions will materialize, we cannot completely rule out a moderate negative impact on our revenue and earnings performance. Overall, we classify this risk as low.

Technological Risks

As a result of preventive measures and reliable systems, we consider the occurrence of technological risks to be unlikely and rate their potential impact on the Group’s revenue and earnings performance as low. We therefore continue to rate the significance of technological risks as low. Potential risks are described below.

Broadcasting equipment. Damage to studio and broadcasting equipment can have financial consequences for our core business of TV. In the event of temporary failures, for example, advertising customers could make guarantee and goodwill claims. We counter this risk with a comprehensive security plan. Back-up systems guarantee a broadcasting process without interruptions, even in cases of malfunction. The redundancy systems are kept at separate locations with multifaceted protection and can be operated remotely if necessary. In addition, the basic infrastructure for the power supply at the Unterföhring location was fully modernized already in 2014. To-the-second reporting, ongoing maintenance, regular exercises, and upgrades when needed keep the systems state-of-the-art.

Studio, post-production, and IT systems. A failure of critical production systems, or manipulation or unauthorized disclosure of business-critical information or personal data, could result in financial losses for ProSiebenSat.1 Group or damage to its image. In this context, the Group began further optimizing file-based production operations in 2016. A program scheduled to last four years was set up for this purpose. It consists of several sub-projects and aims to modernize our process landscape with a focus on material flows and the administration and exploitation of rights. ProSiebenSat.1 Group transferred the content of the TV stations and online offers to a digital pool of materials back in 2009 and consequently reduced its dependency on manual procedures. The Group thereby set standards in the media industry and took advantage of cost benefits. Automation is also helping to minimize risks.

ProSiebenSat.1 invests on an ongoing basis in hardware and software, in firewall systems and virus scanners, and establishes various access authorizations and controls. In order to prevent losses, the Group has multiple computer centers at separate locations, which assume each other’s tasks in the event of a system failure. Drills of crisis scenarios and penetration tests help to simulate potential weaknesses and further improve the IT system. In 2016, the Group subjected all relevant business applications to extensive tests, which confirmed that the degree of maturity was good and had improved further. The effectiveness of the security standards is also examined regularly by the Internal Audit department.

Personnel Risks

Our employees shape the success of ProSiebenSat.1 and promote innovations in the Group with their knowledge and commitment. Skills development therefore represents a key focus of our HR work. This includes selectively securing talented young employees as part of a Group-wide talent management system, as well as supporting employees with courses offered by the in-house ProSiebenSat.1 Academy. At the same time, work-life-balance measures and attractive remuneration models generate long-term loyalty on our employees’ part. Our economic success will also depend on the extent to which we succeed in hiring new specialist staff and qualified managers in the future, too. The number of suitable applicants was improved in terms of quantity and quality by means of standardization of the application procedure, a careers site optimized for mobile devices, and target-group-specific events. Despite these measures, we cannot completely rule out personnel risks. However, we consider their occurrence to be unlikely and their financial impact would be moderate at most. We therefore continue to classify personnel-specific risks as low.

Investment risks

ProSiebenSat.1 Group practices active portfolio management with various different M&A approaches, including company acquisitions through majority or minority interests. The significance of potential risks in connection with M&A measures has not changed in comparison to the previous year.

Risks from majority interests. Acquisitions open up growth and efficiency opportunities for us and faciliate access to new markets. At the same time, investments entail risks with potential financial implications. Equity investments are therefore subject to a continuous monitoring process that also includes impairment testing. In addition to profitability, majority interests in particular entail risks with regard to the integration of the companies acquired. However, we believe that risks from majority interests are unlikely to materialize. Their potential financial impact would be moderate, so we classify this risk as low overall.

Risks from minority interests. In many acquisitions, ProSiebenSat.1 initially acquires a minority interest in a company in order to limit financial risks and gather experience as to how an equity investment can complement the existing portfolio in a way that creates added value. Nonetheless, investments in minority interests entail risks, as the performance and particularly the profitability development may fail to match expectations. This could potentially result in impairment of the investment. However, we consider risks from investment in a minority interest to be unlikely and rate their significance as low. They could have a moderate impact at most.

Financial Risks

The Group is exposed to various financial risks in its operating and financing activities (Fig. 95). The assessment and management of these risks is coordinated centrally. To this end, the Group Finance & Treasury department analyzes the development in the markets, derives potential opportunities and losses for ProSiebenSat.1 on this basis, and regularly assesses the risk situation. The measures required are defined in close cooperation with the Executive Board of ProSiebenSat.1 Media SE. The Finance & Treasury unit is audited annually by Internal Audit as part of risk management. The last audit again generated a positive result and confirmed the efficacy of the system again. Principles, tasks, and responsibilities are defined on a Group-wide basis and regulated via binding guidelines for all subsidiaries of ProSiebenSat.1 Group.

The classifications of the individual risks are explained below. For more information on the hedging instruments, measurements and sensitivity analyses together with a detailed description of the risk management system for financial instruments, please refer to the Notes to the Consolidated Financial Statements.

Financial risks (Fig. 95) |

||||||||||

|

|

|

|

|

||||||

|

Impact |

Probability of |

Significance of |

Change compared |

||||||

|

||||||||||

Financing risks |

very high |

very unlikely |

low |

unchanged |

||||||

Counterparty risks |

very high |

unlikely |

medium |

increased |

||||||

Interest rate risks |

low |

possible |

low |

decreased |

||||||

Currency risks |

moderate |

unlikely |

low |

unchanged |

||||||

Liquidity risks |

very high |

very unlikely |

low |

unchanged |

||||||

Financing risks. Ensuring our financing capability is the most important goal of our financing policy. For this reason, the Group continuously monitors the money and capital markets and assesses developments in these markets as part of risk management. The availability of existing borrowing depends in particular on compliance with specific contractual conditions. These include standard market covenants, which are also subject to regular and systematic assessment. The conditions were complied with once again in the financial year 2016; on the basis of our current corporate planning, a breach is not foreseeable in the future, either. Breaches of covenants could have a very high impact on financial position and earnings performance. However, we consider their occurrence to be very unlikely and classify the financing risk as low overall.

As well as ensuring access to sufficient funds, a second objective is to further optimize capital efficiency. In this context, the Group took advantage of the good conditions in the capital markets in 2016 to diversify its financing portfolio. To this end, the Company diversified its debt structure and issued three promissory notes. In addition, ProSiebenSat.1 strengthened its capital base and thus increased its financial scope for strategic acquisitions by increasing its share capital. The Group pursues clear targets for its leverage ratio, which was within the target range at 1.9 as of the end of the year.

Counterparty risks. Counterparty risk has increased year-on-year as a result of the higher level of cash and cash equivalents and the associated increase in investment requirements. Counterparty risks could have a very high impact on our earnings performance and financial position, but we rate the probability of occurrence of counterparty risks as unlikely and the risk as medium overall. The Group concludes finance and treasury transactions exclusively with business partners which meet high credit rating requirements. The counterparties’ profiles are monitored systematically and continuously in this context. As well as using credit checks, ProSiebenSat.1 limits the probability of occurrence of default risks through a broad diversification of its counterparties. The conditions for concluding finance and treasury transactions are regulated in standardized Group guidelines.

Interest rate swaps and foreign currency forward transactions are recognized in hedge accounting as cash flow hedges. More information can be found in the Notes, Note 30 “Further notes on financial risk management and financial instruments in accordance with IFRS 7,” page 233. ProSiebenSat.1 Group does not deploy derivative financial instruments for trading purposes, but only to hedge existing risk positions.

Interest rate risks. ProSiebenSat.1 Group uses interest rate swaps and interest rate options to hedge its variable-interest term loans against changes in the interest rate caused by the market. The hedge ratio increased to approximately 98 % as at the reporting date compared to approximately 78 % as at the end of 2015. Against this backdrop, we classify the financial implications resulting from interest rate changes as low with regard to their potential extent, with a possible probability of occurrence. Accordingly we classify the significance of interest rate risks as low overall, whereas their significance was still categorized as medium as of the end of 2015. For more information on the hedging instruments, measurements and sensitivity analyses together with a detailed description of the risk management system for financial instruments, please refer to the Notes to the Consolidated Financial Statements.

Risks from ineffectiveness, in connection with falling interest rates, see Note 30 “Further notes on financial risk management and financial instruments in accordance with IFRS 7, page 233.

Currency risks. We also classify currency risks as low. Risks from currency fluctuations can arise if revenues are generated in a different currency from the related costs or capital expenditure (transaction risk). This is particularly relevant for license purchasing at ProSiebenSat.1: The Company concludes most of its license agreements with production studios in the United States and generally settles the resulting financial obligations in US dollars. The Group manages this risk by using derivative financial instruments, primarily currency forwards. As of December 31, 2016, the hedge ratio in terms of a seven-year period was 77 % (previous year: 75 %). Because of the high hedge ratio, we rate the impact as moderate. At the same time, we believe it is unlikely that this risk will materialize.

Liquidity Risks

A lack of available funds, and thus of the ability to service debt adequately at all times, could have very high financial consequences. Liquidity is therefore managed centrally through a cash management system: Anticipated available liquidity is used as an indicator for detecting risk at an early stage. It is calculated and assessed regularly by comparing currently available funds with budgeted figures, taking into account seasonal influences.

As of the end of the year, the Group had cash and cash equivalents of EUR 1,271 million (previous year: EUR 734 million), in addition to which a revolving credit facility of EUR 600 million ensures sufficient liquidity. It is therefore very unlikely that risks will arise from liquidity shortages. We continue to classify this category as a low risk.

Disclosures on the internal controlling and risk management system in relation to the (consolidated) reporting process (section 289 (5) and section 315 (2) no. 5 of the German Commercial Code) with explanatory notes (Fig. 96) |

||||

|

||||

The internal controlling and risk management system in relation to the (consolidated) reporting process is intended to ensure that transactions are appropriately reflected in the Consolidated Financial Statements of ProSiebenSat.1 Media SE (prepared in line with the International Financial Reporting Standards, IFRS) and that assets and liabilities are recognized, measured and presented appropriately. This presupposes Group compliance with legal and company regulations. The scope and focus of the implemented systems were defined by the Executive Board to meet the specific needs of ProSiebenSat.1 Group. They are regularly reviewed and updated as necessary. Nevertheless, even appropriate and properly functioning systems cannot offer any absolute assurance that all risks will be identified and controlled. The company-specific principles and procedures to ensure that the Group’s single-entity and consolidated reporting is effective and correct are described below. |

||||

Goals of the risk management system in regard to financial reporting processes |

The Executive Board of ProSiebenSat.1 Media SE views the internal controlling system with regard to the financial reporting process as an important component of the Group-wide risk management system. Controls are implemented in order to provide an adequate assurance that in spite of the identified risks inherent in recognition, measurement and presentation, the single-entity and Consolidated Financial Statements will be in full compliance with regulations. The principal goals of a risk management system in regard to single-entity and consolidated reporting processes are: |

|||

> |

To identify risks that might jeopardize the goal of providing single-entity and Consolidated Financial Statements and a single-entity and Group Management Report that comply with regulations. |

|||

> |

To limit risks that are already known by identifying and implementing appropriate countermeasures. |

|||

> |

To analyze known risks as to their potential influence on the single-entity and Consolidated Financial Statements, and to take these risks duly into account. |

|||

In addition, our process descriptions and our risk control matrices are subject to an annual review. This ensures that the descriptions are up-to-date and thus also brings about the establishment of consistently effective control mechanisms. These updates combined with regular tests on the basis of samples were part of the PRIME project. Since then, they have been an integrated part of the internal controlling and risk management system in relation to the (consolidated) reporting process. On the basis of the test results there is an assessment of whether the controls are appropriate and effective. Any identified deficiencies in the controls are eliminated, taking into account their potential impact. |

||||

Structural organization |

> |

The material single-entity financial statements that are incorporated into the Consolidated Financial Statements are prepared using standardized software. |

||

> |

The single-entity financial statements are then consolidated to form the Consolidated Financial Statements using modern, highly efficient standardized software. |

|||

> |

The financial statements of the main individual entities are prepared in compliance with both local financial reporting standards and the Group’s accounting and reporting manual based on IFRS, which is available via the Group intranet to all employees involved in the reporting process. The individual companies included in the Consolidated Financial Statements provide their financial statements to Group Accounting in a defined format. |

|||

> |

The financial systems employed are protected with appropriate access authorizations and controls (authorization concepts). |

|||

> |

The entire Group has a standardized plan of accounting items, which must be followed in recording the various relevant transactions. |

|||

> |

Certain matters relevant to reporting (e.g. expert opinions with regard to pension provisions) are determined with the assistance of external experts. |

|||

> |

The principal functions of the reporting process — accounting and taxes, controlling, and finance and treasury — are clearly separated. Areas of responsibility are assigned without ambiguity. |

|||

> |

The departments and other units involved in the reporting process are provided with adequate resources in terms of both quantity and quality. Regular professional training sessions are held to ensure that financial statements are prepared at a consistent and reliable level of quality. |

|||

> |

An appropriate system of guidelines (e.g. accounting and reporting manual, intercompany transfer pricing guideline, purchasing guideline, travel expense guideline, etc.) has been set up and is updated as necessary. |

|||

> |

The efficiency of the internal controlling system in regard to processes relevant to financial reporting is reviewed on a sample basis by the Internal Audit unit, which is independent of the process. |

|||

Process organization |

> |

For the planning, monitoring, and optimization of the process of compiling the Consolidated Financial Statements, the Company uses tools that include a detailed calendar and all important activities, milestones, and responsibilities. All activities and milestones are assigned specific deadlines. Compliance with reporting duties and deadlines is monitored centrally by Group Accounting. |

||

> |

In all accounting-related processes, controls are implemented such as the separation of functions, the dual-control principle, approval and release procedures, and plausibility testing. |

|||

> |

Tasks for the preparation of the Consolidated Financial Statements are clearly assigned (e.g. reconciliation of intragroup balances, capital consolidation, monitoring of reporting deadlines and reporting quality with regard to the data of consolidated companies, etc.). Group Accounting is the central point of contact for specific technical questions and complex accounting issues. |

|||

> |

All material information included in the Consolidated Financial Statements is subjected to extensive systematic validation to ensure the data is complete and reliable. |

|||

> |

Risks that relate to the (consolidated) accounting process are recorded and monitored continuously as part of the risk management process described in the Risk Report. |

|||

Compliance Risks

General Compliance

The objective of compliance is to ensure legally sound management at all times and in all respects. Possible violations of legal statutory regulations and reporting obligations, infringements against the German Corporate Governance Code or insufficient transparency in corporate management can jeopardize conformity to the rules. It is for this reason that ProSiebenSat.1 Group has established a Code of Compliance across the whole Group as well as various guidelines to provide employees with specific rules of conduct for various professional situations. In addition, the employees are systematically given training in the areas of data protection, antitrust law, and bribery.

In order to prevent possible infringements, ProSiebenSat.1 Group has implemented a Compliance Board consisting of the Chief Financial Officer, the Executive Board member responsible for legal affairs, the Group Chief Compliance Officer, the head of Internal Audit, and employees from operating units. The task of the Compliance Board is to establish processes and structures by means of which conceivable illegal actions can be recognized at an early stage and appropriate countermeasures can be initiated. The work of the Compliance Board is managed by the Group Chief Compliance Officer. To bolster the Compliance organization, additional decentralized structures have been implemented. Regular exchanges of experience and information about current trends in different corporate areas have reduced the level of risk.

In view of our effective compliance structures, we believe it is unlikely that compliance risks will occur, but cannot completely rule out a moderate negative impact on the Group’s earnings performance. Accordingly, we classify the Group’s risk from general compliance as low. This risk category is therefore unchanged in comparison to the previous year (Fig. 97).

Other Legal Risks

Regulatory risks. Any unforeseen changes to the regulatory or legal environment could have an impact on individual business activities. ProSiebenSat.1 Group is exposed in particular to various risks in connection with tightened regulations with regard to advertising, forms of advertising, broadcasting licenses or competitions. The Company actively monitors all relevant developments and is in constant contact with the regulators concerned, to ensure that its interests are taken into account as far as possible. In this context, we rate the occurrence of risk from the regulatory or legal environment as unlikely and classify this risk as low overall. However, we cannot completely rule out a moderate negative impact on our earnings performance, and particularly on earnings in the Broadcasting German-speaking segment, if this risk nevertheless materializes.

Guarantees from the disposal of the Belgian TV activities. Through a sale and purchase agreement dated April 20, 2011, ProSiebenSat.1 Group sold its Belgian TV operations to De Vijver NV (“DV”). ProSiebenSat.1 Media SE acted to guarantee the disposal. On the basis of alleged infringements of the accounting and rental contract guarantee included in the purchase agreement, DV has asserted claims for damages against the Company. The contractually agreed maximum liability from all guarantees amounts to EUR 20 million. Based on another assessment and the resulting reassessment of the factual and legal situation, ProSiebenSat.1 Group considers these risks to be very high but very unlikely to materialize. We classify the overall risk as low.

In addition to these risk potentials, legal disputes could damage our business, our reputation, and our brands, as well as incurring costs. These include warranty claims, claims for injunctions, or claims for damages, for example. Furthermore, financial implications may result from changes in legal opinions or in their interpretation. The individual risks are categorized below; further information can be found in Note 28 “Contingent liabilities,” in the Notes to the Consolidated Financial Statements.

Tax risks in connection with the disposal of subsidiaries in Sweden materialized in the financial year 2016. In May 2016, the court of appeal confirmed the first instance verdict of the Swedish fiscal court, in the second instance. The additional tax claims of SEK 374 million (EUR 40 million) were settled in the second quarter of 2016 and reported in the result from discontinued operations after taxes. There is therefore no remaining risk as of December 31, 2016. In the Netherlands, an agreement was reached with the tax authorities in June 2016, resulting in no additional tax charge for ProSiebenSat.1 Group. In this respect, the risk reported in the Consolidated Financial Statements as at December 31, 2015 no longer exists.

Compliance risks (Fig. 97) |

||||||||||

|

|

|

|

|

||||||

|

Impact |

Probability of |

Significance of |

Change compared |

||||||

|

||||||||||

General Compliance |

moderate |

unlikely |

low |

unchanged |

||||||

OTHER LEGAL RISKS |

|

|

|

|

||||||

Regulatory risks |

moderate |

unlikely |

low |

unchanged |

||||||

Claims for disclosure and actions for damages by RTL 2 Fernsehen GmbH & Co. KG and El Cartel Media GmbH & Co. KG |

moderate |

possible |

medium |

unchanged |

||||||

Section 32a German Copyright Act (“Bestseller”, non fiction) |

cannot be assessed |

possible |

medium |

unchanged |

||||||

Guarantees from the disposal of the Belgian TV activities |

very high |

very unlikely |

low |

unchanged |

||||||

Other Risks

Security Risks

Targeted attacks show that politically, economically or ideologically motivated groups represent a growing challenge for our society. Security risks, which were previously a component of technological risks, are now reported separately under the “other risks” category. In view of the preventive measures taken, we classify the security risk as medium overall. We consider the occurrence of security risks to be possible and rate their potential impact on the Group’s revenue and earnings performance as moderate.

The growing number and quality of risk factors require fast and effective emergency plans and clear responsibilities. To this end, ProSiebenSat.1 has defined instructions (campus rules) and established a crisis organization. A large-scale emergency and crisis drill with topical and realistic scenarios in 2016 showed that our measures are effective and ensure protection throughout the Group. At the same time, data protection and securing corporate assets in the form of information are becoming increasingly relevant. ProSiebenSat.1 has also reacted to this, for instance by implementing an information security management system (ISMS) in 2016. The goal is to review the quality of relevant information-processing areas on a regular basis and counter potential cyber-crime in a coordinated way. At the same time, employees’ awareness is raised and they are given training on security issues.

In addition, unforeseeable events such as natural disasters or attacks could have an adverse impact on ProSiebenSat.1’s work processes and thus also on its earnings. We therefore take account of such risks by means of construction-related and technical safeguards, such as fencing off additional properties, among other measures. The Group also took measures in 2016 to tighten access controls for the buildings at the headquarters in Unterföhring. With specialist staff, the Group has also raised the level of protection in line with the risks; the newly established department safeguards individuals and events.