Major Influencing Factors on Financial Position and Performance

- Economic data indicate a positive picture and structural change is driving growth in the TV business.

- Digitalization is changing consumer behavior; we are benefiting from this trend and are investing in new business areas across all segments.

- ProSiebenSat.1 drives the digitalization and diversification of its business activities consistently and already generates 47 % of Group revenues with revenue models beyond video advertising on TV, in the medium term the figure is likely to increase to 50 %.

Impact of General Conditions on the Business Performance

ProSiebenSat.1’s growth is influenced by various factors. In this context, key external underlying data include the German domestic economy and especially private consumption in Germany. This is because their development correlates very closely with investments in TV advertising. In the financial year 2016, ProSiebenSat.1 generated 53.1 % or EUR 2,017 million of consolidated revenues from video advertising on TV (previous year: 60.5 % or EUR 1,974 million). 88.3 % of this was attributable to Germany, the principal revenue market (previous year: 88.4 %).

Economic indicators had a positive impact on advertising in 2016. In the period under review, private consumer spending rose by 2 % and TV advertising investments went up by 8 % (gross) compared to 2015. On the basis of net revenues, market growth is also likely to have developed positively and was within the low single-digit percentage range. Structural changes also influenced growth and stimulated the pricing level. The significance of TV advertising spots is increasing compared to other media. This is because the high reach of television is becoming even more valuable due to the large number of digital offerings. Video advertising is also effective. Multi-sensory experiences using image and sound intensify the impact of advertising.

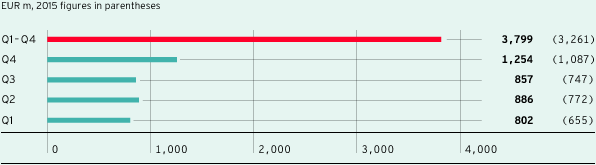

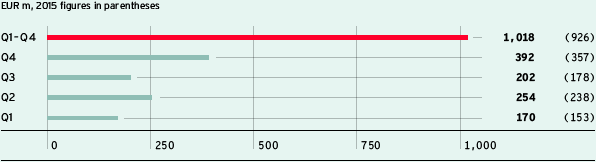

ProSiebenSat.1 is the leading provider of video advertising both in the TV and online sector and again the Group capitalized on these market dynamics in 2016. As with all consumer-related markets, the advertising industry also often reacts to macroeconomic developments in a procyclical manner. In addition, ProSiebenSat.1 Group’s revenue and earnings performance is characterized by seasonal effects and in particular the importance of the fourth quarter. As both propensity to spend and television use increase significantly in the run-up to Christmas, the Company generates a far greater share of its annual revenues in the final quarter. In total, the Group generates approximately a third of its annual revenues and usually around 40 % of its recurring EBITDA in the fourth quarter. This was — adjusted for acquisition effects — also true for the past year (Fig. 56 – 58).

Revenues by quarter (Fig. 56)

Recurring EBITDA by quarter (Fig. 57)

ProSiebenSat.1 aims to establish additional business models in all segments and grow independently of seasonal or economic trends on single markets. The distribution of TV stations in HD quality is an important driver in the core business. The number of HD users further increased in 2016. As a result, the distribution revenues of ProSiebenSat.1 Group grew significantly. At the same time, ProSiebenSat.1 Group has an entertainment portfolio with video-on-demand (VoD) offerings and TV apps which can be used on digital devices and mobile usage. In 2016, the Group also expanded its reach thanks to cooperation agreements and acquisitions.

The market for digital entertainment offerings is growing significantly. This development is being driven by broadband Internet access with fast data transfer rates. The growing importance of the Internet is influencing not only the entertainment industry, but also driving growth in digital commerce. This is reflected in the fact that nearly 50 % of all Germans have purchased a product on the Internet as a result of TV advertising. The momentum of TV towards search requests online is significant, particularly for brands which have their own online store. This is why ProSiebenSat.1 is investing in commerce portals with product areas that are particularly suited for video advertising. The aim is to develop thematically related portfolios — known as verticals — since bundling leads to additional revenue and cost saving potential. An example for this strategy is the investment in online travel offers, which ProSiebenSat.1 manages under the umbrella brand 7Travel. In the financial year 2016, the travel vertical substantially increased its revenues and made a significant contribution to profitable growth. This is mainly attributable to the initial consolidation of etraveli since December 2015. However, revenues relating to other 7Travel portals, such as Tropo, remained below the high figure of the previous year. Tropo mainly offers package holidays in holiday regions; these bookings were shaped by geopolitical uncertainty.

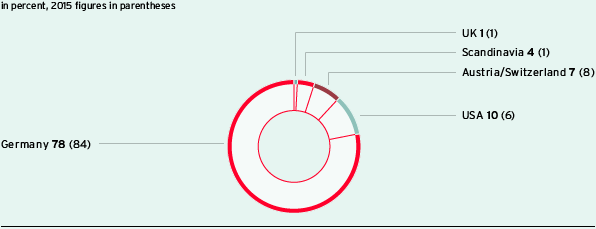

While macroeconomic conditions and industry-specific and structural effects may significantly influence our business performance, currency effects have no material impact on the Group’s financial situation. Although ProSiebenSat.1 is international, the Company generates the majority of its revenues in Germany and thus in the eurozone (Fig. 58). The remaining share of revenues is mainly attributable to the US and Red Arrow’s production business.

The Group also limits risks arising from exchange rate fluctuations with derivative financial instruments. Currency risks may arise from license agreements related to the acquisition of programming rights. ProSiebenSat.1 signs license agreements mainly with US studios. The Group also uses hedging instruments to limit potential interest rate risks. 98 % of variable interest loans and borrowings were covered by different hedging instruments at the end of the financial year 2016 (previous year: 78 %). The Group practices proactive financial management and made use of attractive conditions on financial markets in 2016 in order to further optimize its capital structure.

Revenues by region (Fig. 58)

Changes in the Scope of Consolidation

Once again, the Group’s dynamic growth in the financial year 2016 was mainly characterized by M&A activities in the digital and production portfolio. With kabel eins Doku, ProSiebenSat.1 launched a new free TV station and promoted the internationalization of the digital entertainment business. We report on the most significant changes to the scope of consolidation and other portfolio measures in 2016 in the following section (Fig. 59):

- Digital Ventures & Commerce segment: By agreement signed in May 2016, ProSiebenSat.1 Group increased its share in Stylight GmbH to 100 % via its investment branch 7Commerce. The company is the most successful fashion aggregator in Europe and operates worldwide in 15 countries. In December 2012, ProSiebenSat.1 acquired a 22 % stake in the digital marketplace in a first financing round. The company was fully consolidated in July. In August 2016, the Group also acquired 92 % of shares in WSM Holding GmbH. WindStar Medical specializes in the development and distribution of innovative health items and has been fully consolidated since October. Together with Stylight, ProSiebenSat.1 has bundled these investments in its Lifestyle Commerce ecosystem and uses its digital platforms to sell various health, nutrition, fitness, wellness and fashion offers.

The PARSHIP ELITE Group was also fully consolidated in the fourth quarter; ProSiebenSat.1 had acquired a majority stake of 50.001 % in the company. PARSHIP and ElitePartner are the leading providers of online dating services in the German-speaking region. This transaction underlines our strategic focus on established and profitable growth companies that are market leaders in their segment and strongly benefit from TV advertising. These companies have high potential for synergies within the Group and thus form an important basis for further organic growth. After the comparison portal Verivox and the online travel agency etraveli, the majority stake in PARSHIP ELITE Group was ProSiebenSat.1 Group’s third large acquisition in the Digital Ventures & Commerce segment since the second quarter of 2015. - Content Production & Global Sales segment: At the beginning of the year, the Group acquired a 60 % share in the US production company Dorsey Pictures (previously known as Orion Entertainment) via Red Arrow Entertainment Group. This Denver-based company is a leading US provider of non-scripted TV programs and branded entertainment offers. In the area of outdoor adventure television, Dorsey is one of the largest producers worldwide. A majority stake (65 %) in 44 Blue Studios, a production company based in the US, was acquired in the third quarter of 2016. This was another strategic acquisition in the English-speaking region. This company is a leading producer of non-scripted TV programs, such as docu-series, factual entertainment and adventure and lifestyle formats. With these investments, Red Arrow Entertainment Group further developed its factual entertainment profile. These acquisitions have enlarged Red Arrow’s US production network to nine investments, highlighting our strong growth position on the most important TV market in the world.

ProSiebenSat.1 practices active portfolio management aimed at leveraging synergies by connecting business areas and particularly TV and digital offers. Divestments are also part of this M&A strategy. The Group regularly analyzes its portfolio and assesses potential synergies. In this context, ProSiebenSat.1 Group sold its Games activities in the second quarter of 2016.

Selected portfolio measures and changes in the scope of consolidation in the financial year 2016 (Fig. 59) |

||

|

|

|

Broadcasting German-speaking segment |

7Screen, the marketer of digital out-of-home of ProSiebenSat.1, established in February 2016 |

|

Launch of the new free TV station kabel eins Doku in September 2016 |

||

Digital Entertainment segment |

glomex, an international marketplace for video content, established in March 2016 |

|

Disposal of Aeria Games Europe, a 100 % investment of ProSiebenSat.1 Group, and merger with gamigo AG |

||

Minority stake in Pluto TV, a global video service and leading free OTT television service in the US, in September 2016 |

||

Digital Ventures & Commerce segment |

Increase in stake in Stylight, a digital marketplace for fashion |

|

Majority stake in WindStar Medical, a specialist in the development and distribution of innovative health items |

||

Majority stake in the PARSHIP ELITE Group, the leading provider of online dating services in the German-speaking region |

||

Minority stake in the Käuferportal Group, a leading online portal in Germany for the provision of complex products and services, in November 2016 |

||

Content Production & Global Sales segment |

7Stories production company established in January 2016 |

|

Majority stake in the US production company Dorsey Pictures |

||

Cove Pictures joint venture established in February 2016 |

||

Mad Rabbit joint venture established in April 2016 |

||

Majority stake in the US production company 44 Blue Studios |

||

Minority stake in the US production company Band of Outsiders, in July 2016 |

||