Future Business and Industry Environment

- Private consumer spending reached a record level in 2016. Institutes anticipate a slight slowdown in growth in Germany for 2017, but the general upswing is likely to continue.

- Industry experts’ growth forecasts for video advertising on TV and in digital media are positive. At the same time, e-commerce offerings are becoming increasingly relevant as a result of digitalization.

- The development of the German TV market is likely to reflect the generally good health of the German domestic economy. At the same time, TV has high growth potential compared to other media and is benefiting from structural changes in media use.

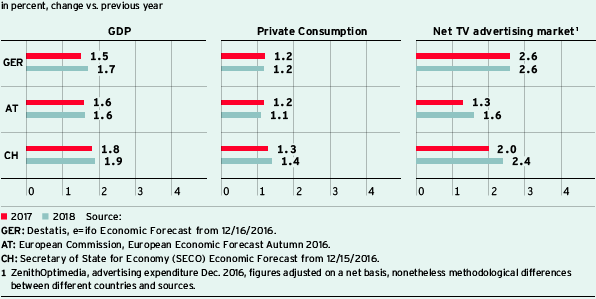

The German economy grew by 1.9 % in 2016. Looking to 2017, the economic research institutes expect this upward trend to continue, albeit at a slower pace than in the previous year. This is particularly due to the lower number of working days. Foreign trade also is not expected to provide significant impetus: Although the export volume could increase, positive domestic demand is likely to result in higher imports at the same time, with the effect that the contribution to growth is likely to be low. By contrast, construction investment and particularly private consumer spending are expected to provide positive effects. In this context, the growth expectations for real gross domestic product (GDP) are between 1.1 % and 1.7 %, while for private consumer spending they are between 1.2 % and 1.5 % (Fig. 101). The German economy could record stronger growth again in 2018. However, institutes see considerable forecast risks, especially in the geopolitical environment. These include the uncertain political and economic course of the new US government, the UK’s upcoming exit from the EU, instability in the European banking system, and the upcoming elections in the core euro-zone countries Germany and France.

Despite these uncertainties, the International Monetary Fund (IMF) anticipates a slight acceleration in global economic growth to 3.4 % in 2017 (2016: 3.1 %). Significant growth impetus could come from the US economy if the announced tax cuts and infrastructure measures are implemented. For the eurozone, the IMF anticipates stable growth of 1.6 % in 2017. As in Germany, the economy is primarily supported by private consumer spending.

The German TV advertising market is closely related to the current and expected economic situation. With a share in GDP of around 54 %, private consumption is the most significant macroeconomic expenditure component and also a key indicator for the development of the TV advertising market. Since private consumer spending is benefiting from persistently robust labor market and income data, prospects for the TV advertising market are also optimistic. In addition, the sector-specific underlying data paint a positive picture overall. TV is the medium with the furthest reach and is continuously gaining market shares as a result of structural shifts. In 2016 as a whole, TV increased its market share by 0.8 percentage points to 48.2 %, while print media lost 1.1 percentage points in the advertising market. However, TV has not fully capitalized on its reach so far. In Germany, an estimated 34 % of net advertising budgets were invested in print media in 2016, although only 6 % of total media usage time is attributable to print. In contrast, TV advertising’s investment volume — on the basis of net data from Magna Global — amounted to 23 %. In many other countries, the budget allocation is the other way round; in the US, for example, the majority of advertising investment is already attributable to TV. Against this backdrop, ProSiebenSat.1 Group believes that TV still has a lot of catching up to do as an advertising medium.

For 2017, the agency groups anticipate net growth of the German TV advertising market at a low single-digit percentage rate (WARC: +2.9 %, ZenithOptimedia: +2.5 %, Magna Global: +1.0 %). ProSiebenSat.1 anticipates stable growth rates averaging 2 % to 3 % on the net TV advertising market in 2017 and expects to grow in line with the market over the year as a whole.

The prospects for digital media are also positive: In-stream video advertising is likely to develop particularly dynamically and drive growth on the online advertising market. For 2017, the agency groups expect the online advertising market in Germany to record net growth of around 8 % (WARC: 6.8 %, ZenithOptimedia: 8.2 %, Magna Global: 9.4 %). The advertising market as a whole is likely to grow by a low single-digit percentage (WARC: 2.2 %, ZenithOptimedia: +2.6 %, Magna Global: 2.1 %).

Forecasts for gross domestic product, private consumption and net TV advertising market in countries important for ProSiebenSat.1 (Fig. 101)

Video-on-demand (VoD) will likewise continue its significant growth. According to own calculations, the subscription video-on-demand (SVoD) market relevant to ProSiebenSat.1 is expected to increase by 112 % by 2018, corresponding to a volume of EUR 636 million. The market volume is set to more than triple by 2020 in comparison to 2016. For the pay VoD market (subscriptions and pay-per-view), the Group anticipates a volume of EUR 845 million by 2018.

According to Statista, Digital commerce is expected to grow at an annual rate of around 8 percent by 2021, as more and more products and services are being purchased online. Overall, the e-commerce market in Germany in 2017 is expected to grow by 9.2 % to a market volume of EUR 55 billion. The Center for Retail Research in Cologne expects online sales in the amount of EUR 79.4 billion by the year 2020, the share of online retailing is expected to increase to 15.2 %. The share of mobile shopping could increase to almost 60 % of online sales by 2020. This would correspond to online mobile sales of around EUR 46 billion. The various areas differ in their dynamic, online travel is expected to grow by up to 5 % in Germany in 2017.